Hewlett Packard Enterprise (HPE) reports earnings for the quarter ending April 2017 on Wednesday, May 31, after market close. The analysts expect CEO Meg Whitman to report a dismal quarter, with a YoY decrease in Non-GAAP earnings per share (-17%) and a YoY decrease in revenues (-24%). HPE management outlook averages the same. Management does not provide a revenues projection.

The average estimated Non-GAAP EPS of $0.35 by analysts is a discouraging drop of -17% YoY and lower than the four-quarter earnings per share average through QE January 2017 of $0.49. This is the result of yet another restructuring and separation. The Enterprise Services business segment was merged with Computer Sciences Corporation and renamed DXC Technology, effective April 3. Accordingly, HPE management estimates for Non-GAAP earnings per share for Hewlett Packard Enterprise were dropped from an average of $0.43 to an average of $0.35 for the QE 4-30-17.

Since the initial restructuring and separation from HP (HPQ), beginning with the QE January 2016, Non-GAAP earnings per share have been $0.45, $0.61, $0.49, $0.42, $0.41 for the past five quarters, in reverse chronological order.

Non-GAAP and GAAP net earnings and earnings per share have not tracked together for the past five quarters. Non-GAAP earnings per share have averaged $0.48 for the past five quarters, GAAP EPS has averaged $0.40.

Earnings per Share Year Over Year Growth Rate (%)

The estimated Non-GAAP EPS for the QE 4-30-17 of $0.35 is a -17% decrease year over year, from $0.42 for the QE April 2016. The prior QE 1-31-17 was a much better +10% increase YoY, from $0.41 to $0.45. I am not including data from before the restructuring, which began QE 1-31-16. Therefore, it will take a few more quarters to build a history.

Net Revenues

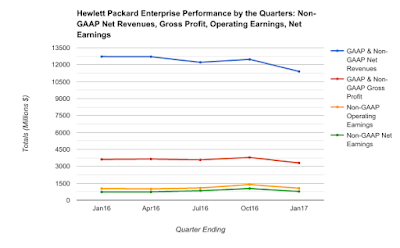

Net revenues have averaged $12.3 billion for the five restructured quarters reported and been in an obvious decline. A decrease to $9.6 billion is projected for the next QE April 2017 because of the separation of the Enterprise Services segment. This would be the lowest net revenues recorded since the initial restructuring and separation from HP.

Estimated QE April 2017 Revenues (GAAP &Non-GAAP):

* Analyst Estimates: $9.64B avg, $7.32B low, $10.44B high, 21 analysts

* Prior Year $12.71B = -24% YoY

* Prior Quarter $11.41B = -15% QoQ

* HPE Management Outlook: None

Revenues by Segment

Quarterly revenues by segment, before eliminations (>100%), are comprised of Enterprise Group (55%), Enterprise Services (35%), Software (7%), Financial Services (6%), and Corporate Investments (now 0%). The segment detail, drilling down deeper, is in the chart below. This revenue mix will change significantly in the next quarter, with the spinoff of the Enterprise Services to DXC Technology (DXC).

The above detailed segment trends are not encouraging. As a percentage of net revenues at QE 1-31-17, before eliminations (>100%), the major detailed segments are Servers (27%), Infrastructure Technology Outsourcing (23%), Technology Services (17%), and Application and Business Services (12%). These four segments comprise 79% of Hewlett Packard Enterprise revenues.

Return on Assets

Hewlett Packard Enterprise is just now reporting enough quarters post-restructuring to calculate the annualized return on average assets. Non-GAAP net earnings are consistently higher than GAAP net earnings. However, Non-GAAP ROA is a meager 4.3% and GAAP ROA is an even lower 4.1%. These ROAs are below average for a leading edge technology company.

Conclusion

Financial Performance: Non-GAAP & GAAP financial performance has slowed. Non-GAAP EPS peaked at $0.61 for the QE 10-31-16. GAAP EPS peaked at a very high $1.32 for the QE 7-31-16, but this was because of a $2.2 billion gain on the divestiture of H3C. Analyst’s project an average EPS of $0.35 as does HPE management. The Enterprise Services segment will have been spunoff in the next quarterly earnings report.

HPE Headwinds: In the prior quarterly earnings press release, management said, “Three significant headwinds have developed since Hewlett Packard Enterprise provided its original fiscal 2017 outlook at its Securities Analyst Meeting in October 2016: increased pressure from foreign exchange movements, higher commodities pricing, and some near-term execution issues. Given these challenges, the company is reducing its FY17 outlook by $0.12 in order to continue making the appropriate investments to secure the long-term success of the business.”

Financial Position: Financial position is adequate with a capital to assets ratio of 41%. Working capital is $3.84 billion, the lowest in five quarters. The current assets to total assets ratio is 33%, so there is liquidity. The total debt ratio, both short-term and long-term, is a little high at 21% of total assets. The balance sheet will change as a result of the separation of the Enterprise Services segment in this next quarterly earnings report.

Dividends: HPE declared a dividend of $0.065 on March 23, payable July 5, for stockholders of record June 14. At a selected benchmark $19.00 stock price this is a 1.4% annualized yield. The dividends paid for the past five quarters have been $109M, $92M, $91M, $94M, $96M, in reverse chronological order.

Stock Repurchases: HP repurchased $641 million of common stock in the QE January 2017. These repurchases, combined with the $$109M dividends equal $750M earnings returned to shareholders. The repurchases for the past five quarters have been $641M, $0M, $1.45B, $15M, $1.20B, in reverse chronological order.

Stock Price: Despite the financial performance struggles, the stock has been in a long-term upward trend. HPE does have price support from the dividends paid, dividend yield, stock repurchases, and institutional buyers. Any lower price, and therefore higher dividend yield, will provide support. With a stock beta of 1.84, this stock provides opportunities for short-term fast traders.

Stock Evaluation & Opinion: As an intermediate-term to long-term investor, I consider Hewlett Packard Enterprise stock to be an intermediate-term Hold, compared to Buy or Sell. For now, I am Neutral on HPE stock intermediate-term, compared to Positive or Negative. Long-term will hopefully have better prospects, but that has not been proven yet. With this latest restructure and separation, I’m in the wait and see camp. I’d rather bide my time and see what the newly restructured HPE can be and do. Are the multi-year restructurings and separations over that began with HP Inc. and now with Hewlett Packard Enterprise? HP and HPE management have been looking for the light at the end of tunnel for years.

Restructuring

For all the data and commentary above, I have used only information since the original restructuring and separation from HP (HPQ), which was effective for the QE January 2016. There have now been five quarters reported since that separation. Additional restructuring expenses continue to be incurred.

As noted earlier in the article, yet another separation has occurred. The Enterprise Services business segment was merged with Computer Sciences Corporation (CSC) and renamed DXC Technology (DXC) effective April 3, 2017. This will materially affect both financial position and financial performance for Hewlett Packard Enterprise beginning with the QE April 2017. Both the balance sheet and income statement may be restated by management for prior quarters to reflect the spinoff.

About Hewlett Packard Enterprise

HPE is an industry-leading technology company that enables customers to go further, faster. With the industry's most comprehensive portfolio, spanning the cloud to the data center to workplace applications, our technology and services help customers around the world make IT more efficient, more productive and more secure.

^v^ ^v^ ^v^